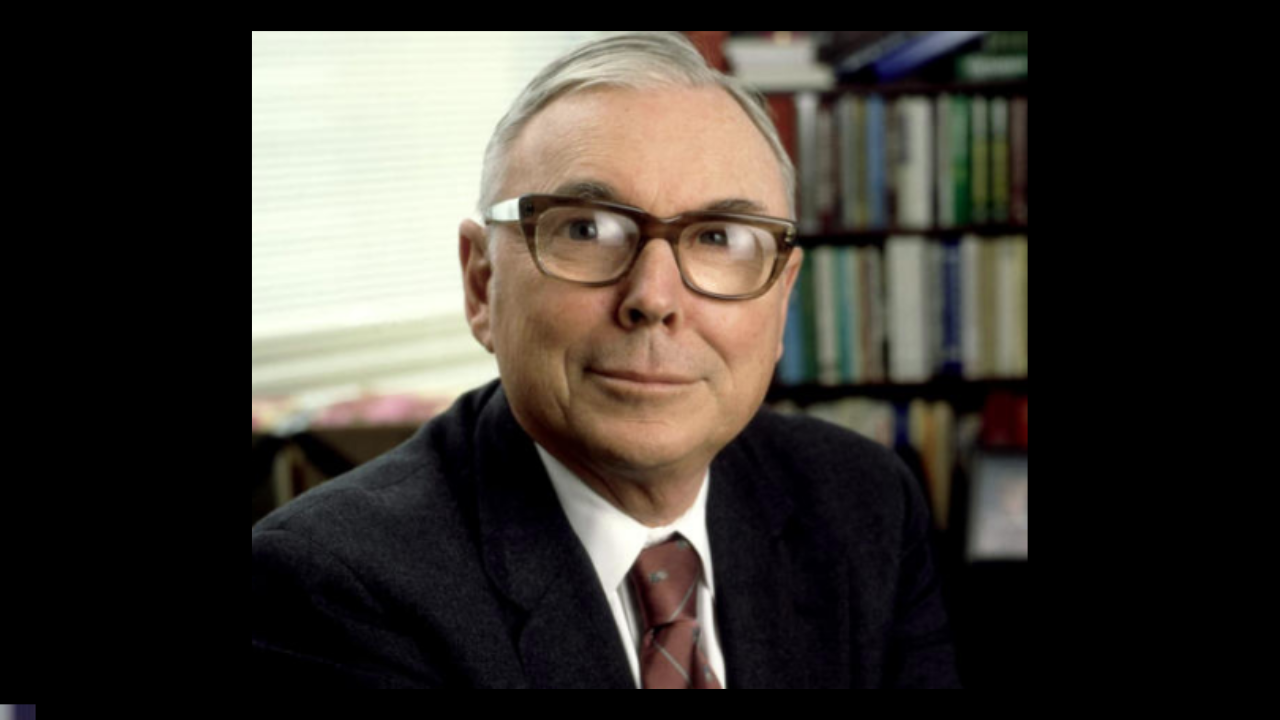

Charlie Munger, a longtime lieutenant of Berkshire Hathaway’s Warren Buffett, turned into acknowledged for his sharp remarks on lifestyles and investing. Munger has died at age ninety-nine, simply short of his one centesimal birthday.

Over time, Munger seemed Buffett to take questions from Berkshire shareholders at the conglomerate’s annual meeting, and his remarks frequently upstaged the boss.

Many of Munge’s often-repeated quotes approximately investing were stated in the course of television interviews, or at different public conferences. A few have been recorded in his 2005 e-book Bad Charlie’s Almanack: The Wit and Information of Charles T. Munger.

The subsequent are several of Munger’s thoughts on life and investing, pulled from an expansion of sources, including the almanac.

“the massive cash isn’t inside the shopping for and promoting…but within the ready.”

There’s plenty of pain and no laugh. Why would you need to get on that trolley?”

“spend every day trying to be a little wiser than you had been when you woke. Day by day, and at the end of the day, if you stay lengthy sufficient, like most people, you will get out of life what you deserve.”

“in my complete lifestyle, I have acknowledged no clever human beings (over a huge problem rely on the place) who didn’t study all the time — none, zero. You’d be surprised at how an awful lot Warren reads, and at how a lot I examine. My youngsters giggle at me. They think I’m a book with a couple of legs protruding.”

Then there is the off-the-cuff feedback Munger made in response to target audience questions in public forums over the years.

“I suppose existence is a whole series of opportunity prices. You know, you bought to marry the first-rate character who is handy to locate who will have you. Funding is lots the same sort of a system,” he informed shareholders in 1997 at the Berkshire Hathaway annual meeting.

“I think cost buyers are going to have a harder time now that there are so a lot of them competing for a faded set of opportunities,” Munger stated in May additionally at this year’s annual meeting. “my advice to value buyers is to get used to making much less.”

“in case you blend raisins with turds, they’re nonetheless turds,” Munger informed a shareholder at the 2000 Berkshire meeting after a question approximately the hypothesis in net shares.

“from time to time I name it crypto crappo, sometimes I name it crypto sh—. It’s just ridiculous that all and sundry might purchase these items,” Munger said at the annual shareholder meeting of each Day Magazine Corp.

And at the 2018 Berkshire annual assembly, Munger answered a query about political polarization this way: “There’s a bent to suppose that our gift politicians are a good deal worse than we had within the past. But we tend to forget about how awful our legislators have been inside the beyond.”