While you rent a car, you’ll accept a choice at the end of the condo period to buy it or circulate directly to a new vehicle.

It works fantastic for automobile owners, so why not follow this principle to homeownership?

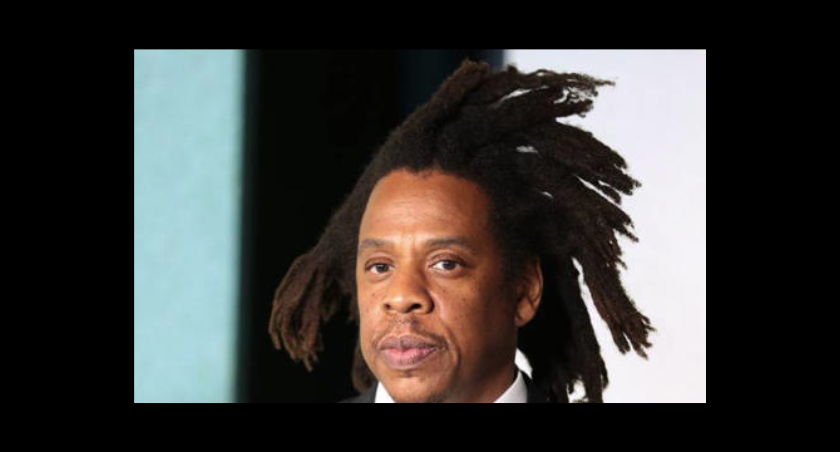

Buyers surely seem to assume there’s something to the idea. Several startups within the hire-to-very own, or hire-to-very own, class had been catching the eye of large gamers like Jay-Z’s undertaking capital arm of ROC state, the National Association of Realtors’ 2nd-century ventures, and Google Ventures (GV).

Two businesses, Landis, and Divvy Homes, have raised tens tens of millions of bucks in funding during the last 12 months. Some other huge calls inside the area, home companions of the United States, turned into received by way of opportunity investment company Blackstone in 2021 for $6 billion.

Market studies published at the cease of 2022 indicate that the $10 billion rent-to-very-own industry is projected to grow over the next five years to be worth over $15 billion by 2027.

Do not pass over

Industrial actual property has outperformed the S&P 500 over 25 years. Here’s the way to diversify your portfolio without the headache of being a landlord

Wealthy young individuals have misplaced self-assurance in the inventory marketplace — and are having a bet on these 3 assets. Get in now for robust lengthy-term tailwinds

Lease-to-own agreements permit potential homebuyers to lease and live in homes they’d at some point like to buy. Whilst you’re renting, you’ll pay a little greater every month that may be used as your price as soon as the condo term is up.

This buying version is advertised as a manner to transition to homeownership while not having to clear the hurdle of affording a down payment.

But the closer you look at this arrangement, the more cracks start to reveal.

What are hire-to-personal or lease-to-own homes?

With a hire-to-personal settlement, you may chip away at your fee over the years, in preference to having to have it in cash in advance. Your down fee installments assist in constructing fairness in the home before you’re the reliable owner.

In case you’ve had financial struggles in the past, you’ll also eke out a little more time to get your budget in a suitable form, like improving your credit rating, so you can qualify for a higher rate for your mortgage.